Do your employees use company-owned or leased vehicles for personal reasons? If so, you need to know how to handle reporting personal use of company car for wage and tax purposes.

Read on to learn:

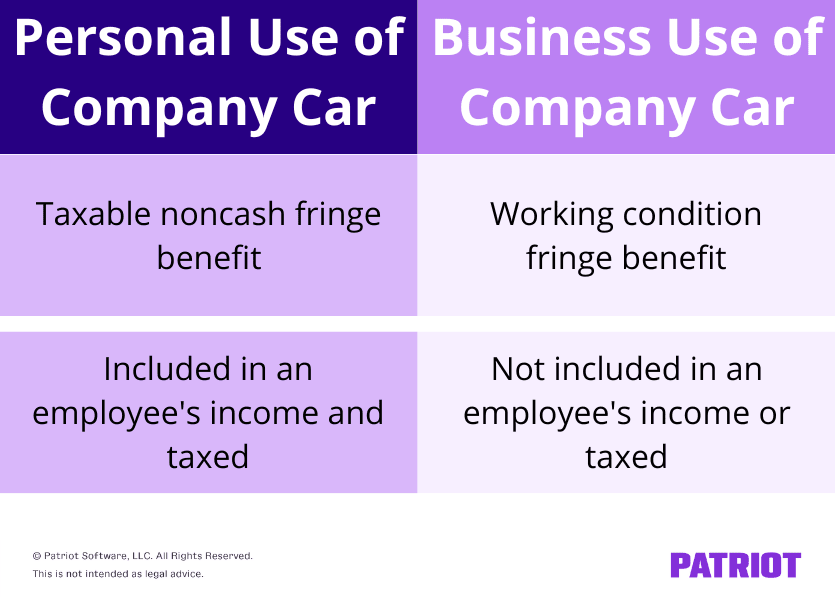

Personal use of a company car (PUCC) is when an employee uses a company vehicle for personal reasons. Driving a company vehicle for personal use is a taxable noncash fringe benefit (aka benefit you provide in addition to wages). As a result, you generally must include the value of using the vehicle for personal reasons in the employee’s income and withhold taxes.

If the employee uses the company car strictly for business purposes, treat the usage differently. Business use of a company car is considered a working condition fringe benefit. A working condition fringe benefit means the value of using the vehicle isn’t included in the employee’s income or taxed because the employee needs it to perform their job.

So, what’s considered personal use of a company car? PUCC includes:

If an employee does use a company car for one of the above purposes, determine its value and include it in the employee’s compensation for tax purposes.

In some cases, an employee’s personal use of a company car is exempt from inclusion in wages and taxes.

De minimis means too small for consideration. If an employee’s PUCC is so small that it would be unreasonable or administratively impracticable (e.g., infrequent and brief side trips) to track, you can exclude it.

If a company vehicle has a special design that makes personal use unlikely, exclude personal use from employee wages.

Qualified nonpersonal use vehicles include:

You can get more information about the qualified nonpersonal use vehicle exception in Publication 15-B.

Do not include personal use of a demonstration vehicle if the employee is a full-time automobile salesperson or sales manager within the sales area of the dealership.

To qualify for this exception, you must substantially restrict the employee’s PUCC:

Personal use is limited to the greater of either a 75-mile radius of the dealership or the employee’s actual commuting distance.

You can get more information about the personal use exemption for demonstration vehicles in Publication 15-B.

So, how exactly do you calculate the value of an employee’s personal use of a company car? You can use one of the following methods to determine the value of PUCC:

The general valuation rule is the most commonly used method for determining the value of fringe benefits. However, you can use one of the special valuation rules (cents-per-mile, commuting, or leave value) for determining PUCC value.

Remember not to include the working condition benefit in the PUCC value. Again, working condition benefit is the vehicle use that the employee uses for business reasons.

You can learn more about each of these rules in IRS Publication 15-B.

Under the general valuation rule, calculate the value of PUCC using the fair market value (FMV).

The PUCC’s fair market value is the price the employee would pay a third party to buy or lease the benefit in the same geographic area and under the same or comparable terms.

Under the vehicle cents-per-mile rule, determine the employee use of company vehicle value by using the standard mileage reimbursement rate.

To find an employee’s PUCC value under the cents-per-mile rule, multiply their personal miles driven by the IRS standard mileage rate.

For 2024, the standard mileage rate is 67 cents per business mile drive. The rate includes the costs of maintenance, insurance, and fuel.

To use this rule, you must meet the following conditions:

You cannot use the cents-per-mile rule for a vehicle if its value on the first day of use exceeds an amount set by the IRS. These values change every year.

If you use the cents-per-mile rule for a vehicle, you must use the rule for all following years. However, you can use the commuting rule if the vehicle qualifies. And if the vehicle no longer qualifies for the cents-per-mile rule, you can use another rule.

Does an employee use a company vehicle to commute to and from work? If so, you might opt for using the commuting valuation rule.

Under the commuting rule, the PUCC value is $1.50 for a one-way commute, per employee. You can use this rule if you:

Special note: There is also an unsafe conditions commuting rule that you might be able to use. Like the regular commuting rule, the value is $1.50 for a one-way commute. The unsafe conditions commuting rule applies if the employee would ordinarily walk or use public transportation and you only allow the employee to use the vehicle for commuting. For more information, see IRS Publication 15-B.

Under the lease value rule, determine the PUCC value by finding the vehicle’s annual lease value. Exclude any amount the employee uses for business purposes. So, you would multiply the annual lease value by the percentage of personal miles (out of total miles) driven.

To use the lease value rule, follow these steps:

If you provide fuel to the employee, add 5.5¢ per personal use mile.

See it in action: Let’s say you have an employee who drove 30,000 total miles, of which 5,000 are personal miles. The FMV of the vehicle is $17,500. Using the Annual Lease Value Table, you find that its lease value is $4,850. The employee’s percentage of personal miles is 17% (5,000 / 30,000). So, the employee’s PUCC value is $824.50 ($4,850 X 0.17).

When withholding and reporting taxes for personal use of a company vehicle, follow the rules for withholding from and reporting on non-cash fringe benefits.

Pro tip: Have employees keep detailed records, such as mileage, business purpose, and time and place of travel. That way, you have the records to back up wage and tax reporting.

Make employee payments & tax withholding easy with Patriot PayrollWhen an employee uses a company vehicle for personal use, they immediately get that benefit. But, using the benefit and being paid for it are different.

You may treat the benefit as being paid on a pay period, monthly, quarterly, semiannual, annual, or another basis. This is when you include the fair market value in the employee’s wages. You must pay the employee for the benefit at least annually.

You can change the payment period at any time. The fair market value for all personal use benefits in a calendar year must be recorded by December 31 of that year.

Keep in mind that you don’t have to use the same payment schedule for all employees. You might use a monthly basis for one employee but a quarterly basis for another.

Also, you don’t have to tell employees or the IRS about the frequency you choose to include the benefit value in employee wages.

Let’s say you include the benefit value semiannually in employee wages. An employee uses a company vehicle for personal use during the first half of the year. But you don’t include the benefit value in the employee’s wages until the very end of the first half of the year. This is when you consider the benefit “paid” to the employee.

If you want until the end of the year to include the entire benefit amount in the employee’s wages, the employee might not have enough wages to cover the taxes. If this happens, you are liable for uncollected Social Security and Medicare taxes, in addition to your own share.

There is a special accounting rule that can help with paying and reporting benefits.

You can treat benefits provided in November and December (or a shorter period during those two months) as being paid during the next year. This gives you extra time to value the personal use of a company vehicle.

There are some restrictions:

If you choose to use the special accounting rule, benefits shifted to the next year must use the valuation rules for the next year. For example, if the cents-per-mile rate increases, you need to use the new cents-per-mile rate when calculating the value of the benefits.

There are two methods for withholding:

With either method, subtract the benefit amount from the employee’s wages after you calculate the withholdings. If you don’t subtract the benefit amount, you’d essentially be paying the employee twice for the vehicle use. The employee would receive the value of the benefit when they use the vehicle, and they’d receive the value again in their wages. It’s important to subtract the benefit amount so you don’t give the benefit value twice.

You can choose not to withhold federal income tax on an employee’s personal use of an employer-provided vehicle. You can also choose to withhold federal income tax for some employees’ personal use, but not for others.

If you decide not to withhold federal income tax, notify affected employees in writing by January 31 of the year you make your decision, or within 30 days after the employee first gets the vehicle, whichever is later. If you change your mind about withholding, you must notify employees in writing again.

Even if you don’t withhold federal income tax, you must still withhold FICA tax. Deposit the taxes according to deposit rules and your frequencies.

Report the value of personal use of a company vehicle on Form 941 and the employee’s Form W-2.

You use Form 941 (or Form 944) to report employee wages, federal income tax withholding, and withholdings and contributions for FICA taxes. Form 941 is a quarterly form, and Form 944 is an annual form.

Report the fair market value of an employee’s personal use on Form 941 in the quarter it is considered paid. You must report the fair market value of the benefit for a year no later than the fourth quarter Form 941 for that year.

Use Form 944 instead of Form 941? Report the fair market value of an employee’s PUCC on Form 944.

Report the value of the personal use of the company vehicle on the employee’s Form W-2. Include the amounts in Boxes 1, 3, and 5. Also, report the amounts you withheld in Boxes 2, 4, and 6.

If you choose not to withhold federal income tax, you must still include the fair market value of the benefit in Box 1.

If you treat all employee use of a vehicle as personal use, include the total benefit amount in Boxes 1, 3, and 5. Also, report the benefit amount in Box 14 or a separate statement to the employee.

This article has been updated from its original publication date of December 29, 2017.

This is not intended as legal advice; for more information, please click here.